Since the Affordable Care Act was signed in March 2010 and began to enroll many more Americans in coverage in 2014, many observers have asserted price inflation in health care has been moderate by historical standards. Such claims are misleading because many observers decline to differentiate between nominal and real inflation. In fact, prices for health-related goods and services have increased significantly.

The measurement of inflation most economists use to gauge the impact of price changes on ordinary people is the Consumer Price Index (CPI), which has been published for decades by the U.S. government’s Bureau of Labor Statistics. It measures prices facing consumers for all the goods and services we buy.

For many decades, CPI usually increased between three and four percent annually. Health prices increased seven or eight percent. Since the Great Recession, prices for the basket of health-related goods and services have increased by only three or four percent. Health costs under control? Unfortunately not. Because overall CPI has been pretty close to zero recently, even relatively moderate nominal price hikes for medical care are actually substantial real price hikes, relative to other goods and services.

Nevertheless, both the CPI and the price index for medical care rose just 0.1 percent this February. This is the sixth month in a row we have enjoyed medical price relief in the CPI. Even prices of prescription drugs dropped by 0.2 percent. Some components – medical equipment and supplies, outpatient hospital services, and health insurance jumped a bit, but not enough to drive overall medical prices higher. Medical price inflation contributed nine percent of CPI for all items.

Over the last 12 months, however, medical prices have increased much more than non-medical prices: 3.5 percent versus 2.7 percent. Price changes for medical care contributed 11 percent of the overall increase in CPI.

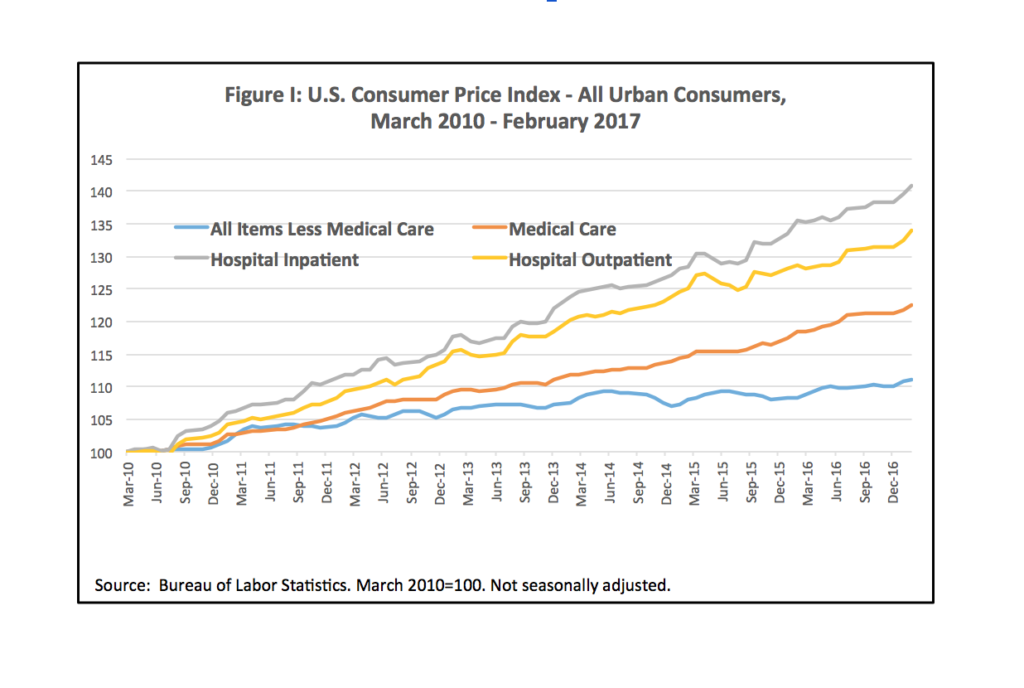

Further, if we go back to March 2010, we see medical prices within CPI have risen over twice as much as the CPI less medical care since President Obama signed the ACA (Figure I). While the CPI less medical care increased by 11 percent, the price index for medical care increased by 23 percent.

Within medical care, hospitals are largely responsible. The price index for inpatient services increased by 41 percent and the price index for outpatient services increased by 34 percent. This includes both direct patient spending and the share of insurance premiums allocated to hospitals’ claims.

Currently, drug makers are under intense political pressure for their prices. However, drugs are still a much smaller share of health spending than hospital claims are. Hospitals have prevented Congress from taking steps such as so-called “site neutral” payment, which would reduce the outpatient fee schedule for many procedures to equal fees paid to ambulatory sites.

This success, while hard on taxpayers and patients, is likely to continue, according to actuaries at the Centers for Medicare & Medicaid Services, who anticipate future health price inflation:

For 2018 and beyond, both Medicare and Medicaid expenditures are projected to grow faster than in the 2016–17 period, and more rapidly than private health insurance spending, for several reasons. First, growth in the use of Medicare services is expected to increase from its recent historical lows (though still remain below longer-term averages). Second, the Medicaid population mix is projected to trend more toward somewhat older, sicker, and therefore costlier beneficiaries. Third, baby boomers will continue to age into Medicare, with some of them dropping private health insurance as a result. And finally, growth in the demand for health care for those with private coverage is projected to slow as the relative price of health care—the difference between medical prices and economy wide prices—is expected to begin gradually increasing in 2018 and as income growth slows in the later years of the projection period.

(Sean P. Keehan, et al., “National Health Expenditure Projections, 2016-25: Price Increases, Aging Push Sector to 20 Percent of Economy, Health Affairs, 2017, 36(3): 553-563.)

Hospitals’ ability to push prices up, even in difficult economic times, has been sustained through a period of traumatic change in both the economy and health care.

—

Based near Washington, DC, John R. Graham is a well established financial, economic, and policy analyst in the health sector. Graham is often called upon to advise government and business leaders. In January 2017, he was invited to testify before the U.S. House of Representatives’ Ways & Means Committee on the effectiveness of the Affordable Care Act’s individual mandate to buy health insurance. Since the 2016 election, he has engaged with many stakeholders on options for health reform after repealing and replacing the Affordable Care Act.

Graham received his M.B.A. from the London Business School (England) and his B.A. (with Honours) in Economics & Commerce from the Royal Military College of Canada.